We are all looking to build a financial masterpiece for our lives. Things may not be perfect today, but perfection is what we are all in pursuit of. But where do we start, and how do we get ahead? Questions are the answers.

In his best-selling book The Behavior Gap, Carl Richards defines a framework using the ‘5 big questions’ to plan your financial masterpiece.

What seems like a complicated process (so much so that we often give up before we even start) is really just a balancing act. I’ve found that it helps to put a framework around this process, which we can do by asking a few questions:

1. How much can you reasonably save?

2. What is your rate of return?

3. How much do you need?

4. When will you need it?

5. What do you want to leave?

While these questions may sound simple, they’re not necessarily easy to answer. Go ahead, try it !!

Certainly there are more questions that you can ask, but think of these five as different choices that you can make to keep things in balance.

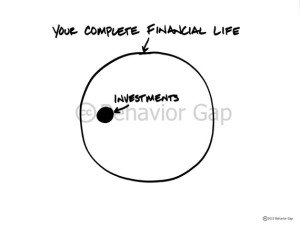

Notice that only one of the questions has to do with investments. Yet most of what we read, most of our anxiety and most of what we think about involves the rate of return. But rate of return is only one small part of the equation. If you don’t want to deal with the risk of investing in the stock market, you can make another trade-off. Save a little more if you can. Or if you can’t, consider retiring a little later or pursuing a second career. Notice another thing, only one of the factors (what is your rate of return?) is something that is relatively out of your control, while the rest of the factors definitely are.

The idea is that it’s a balancing act rather than a single-minded pursuit of the highest return. Planning for your financial future requires thought, frequent course corrections and above all, an effort to keep things in balance. Again, while these questions may be simple, they certainly aren’t easy. The reality is that finding the balance is going to be a different process for everyone.

Did you find this piece helpful? We thrive on your feedback and are always eager to hear and learn from you. Look forward to your comments.