All of us grew up reading and thoroughly believing the moral of the ‘Hare & Tortoise’ story. But then we all grew up and ‘life’ happened. Sadly, ‘Slow and Steady’ soon got replaced by ‘Fast and Crazy’ as the new winning mantra.

For the past 50 years, Fast Food has taken the world by storm – and literally so. This, despite the obvious ill effects. It is therefore refreshing to note how the “Slow Food” movement has caught on and also that slow food is the new good food.Promoted as an alternative to fast food, it strives to preserve traditional and regional cuisine and encourages farming of plants, seeds and livestock characteristic of the local ecosystem… (Wikipedia)

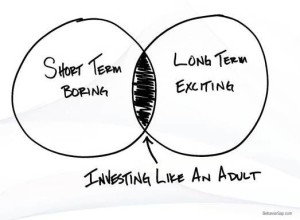

The same analogy can be applied to us as investors and the way we go about investing. We do know that patience is a virtue that is required for long term investment success. But in the face of the constant ‘noise’ and mindless bombardment from the financial media and other pundits, it is easy to get carried away in the short term.

The objective of investing is to create and preserve wealth while reaping benefits from short term opportunities in right measures. But due to the constant hawking of financial news in the garb of knowledge and information, there is a constant conflict. This conflict hassled many of us to burn our fingers.

As Carl Richards (www.behaviorgap.com) points out:

- Slow and steady capital is far more concerned with avoiding large losses than with chasing the next great investment. The difference between making a killing and getting killed.

- Slow and steady capital means you can have a life. If you accept the fact that slow and steady wins the race and you find a way to invest that way, you can turn off all the noise of Wall Street (Dalal Street)

- Slow and steady capital knows that the goal of investing is to have the capital you need to fund your most important goals. If your goal is to have something to talk about at the next neighborhood party, try something else.

- Being slow and steady is hard because it always seems that someone is getting rich quick. Sometimes it only takes a few winning trades for someone to forget the losers.

So what’s cooking up with your investments? And if you decide to be slow and steady, remember to take ALL stories of people getting rich quick with a huge grain of salt.

Did you find this piece helpful? We thrive on your feedback and are always eager to hear and learn from you. Look forward to your comments.

There is a reason a home cooked meal has greater value than fast food…and it’s not just because of the ingredients. It’s because a meal cooked at home is slow. It has to be. We can’t make something with love in a microwave. The process is slow.

Slow is what allows us to learn. Slow is what allows us to trust. Slow is what allows us to feel love for each other. The problem with slow is it requires time. And that’s exactly why it’s so powerful. It is the single greatest gift we can give someone – to give them our time. To offer hours, days, weeks, months or more knowing full well that any time we spend we will not get back, ever. Time is a non-refundable commodity. Once it’s spent, it’s gone. Time, more than money, has real, lasting value.

Anything slow, by definition, takes time…and that’s exactly what makes it special.