B eing the only goal-based investing firm in India with an established practice for doctors, we have met more than 2,000 doctors over the last 21 years. Our experience and association with them has helped us understand their challenges, insecurities, mindset about money, and approach to managing their finances.

As a doctor, you face a unique set of challenges. You spend more than 10 years graduating from medical college, some of you do so with debt. And then you work, maybe more than 12/14 hours a day to gain as much experience as possible, not worrying about the income you may be earning. Then you may have taken on large liabilities to start or buy into a practice. After this starts the phase of building the practice and running the clinic.

But perhaps the biggest challenge you face as a doctor is, "Are you also securing your financial future beyond your current practice?"

That's the secret to creating financial freedom. If you're not creating wealth separately from your practice, you could end up "chained to the chair," unable to retire because you can’t afford to lose the revenue stream.

Hence it is imperative to invest the "Right Way", even if later in life.

To take care of all this, choose the "Right Coach" who will always handhold you and has your back.

So, who is a Right Coach and what is the Right Way?

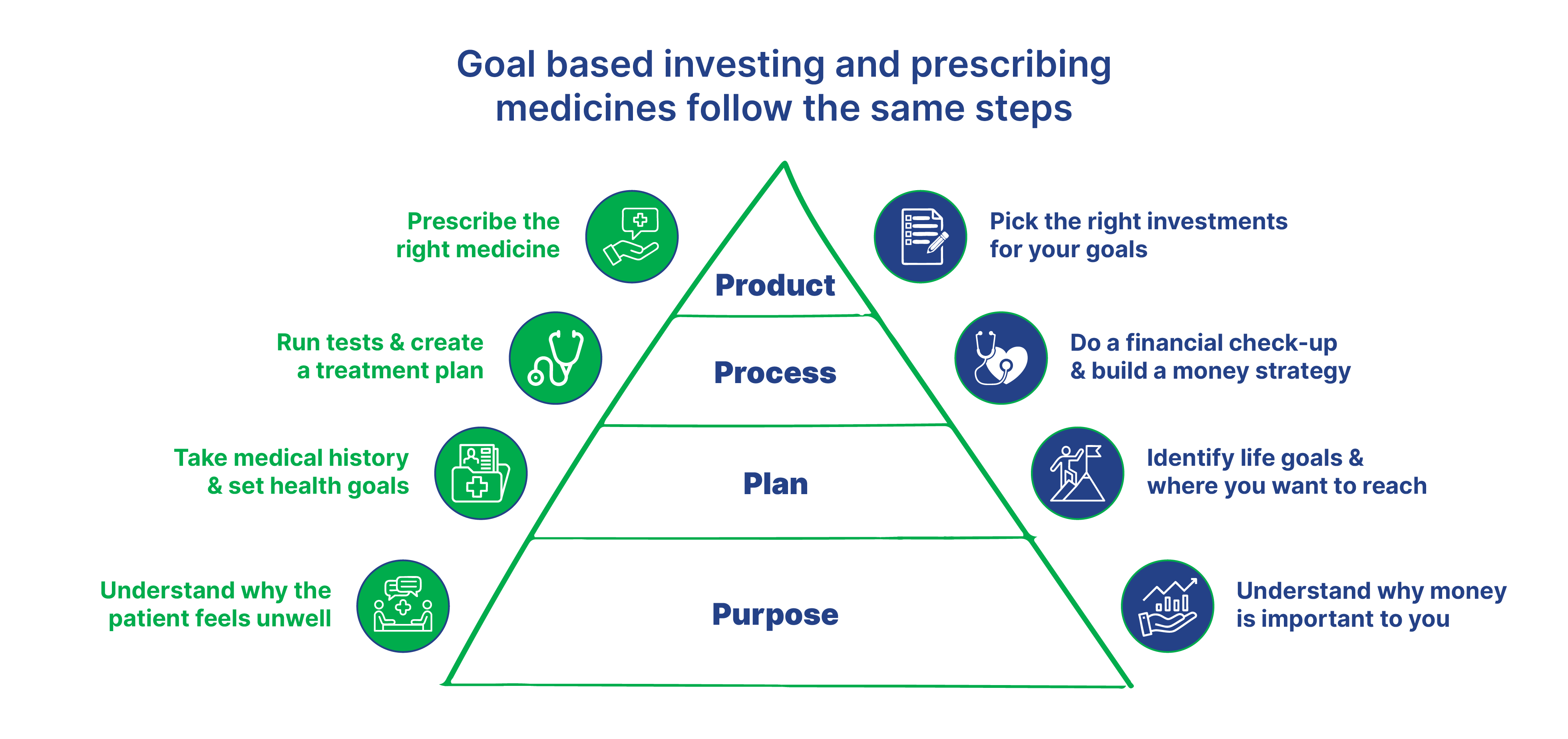

The best way to gauge if an Coach is the 'Right Coach' is to see if he follows a process similar to what doctors follow with their patients.

Financial Independence is a not a destination…but a journey!

To know how we put some of our Doctor Clients on the path on Financial Independence click here