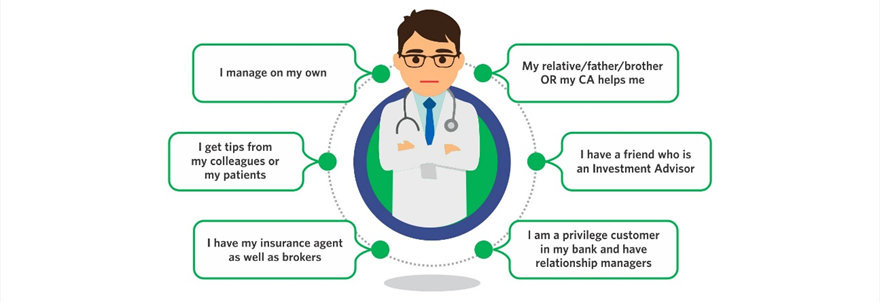

Whenever we asked Doctors, who guides them on financial matters, we almost get the same answers-

Anyone with some knowledge of finance is assumed to be a Financial Coach. These are not your Financial Coaches!

If you were seeking medical help, would you go to a DOCTOR or to a CHEMIST?

Similarly, Planning of your Finances is a specialized field that requires a different QUALIFICATION and EXPERTISE. For example, a CA may be a tax wizard, but he is NOT a FINANCIAL COACH. A lot of financial distributors and bankers try to call themselves Financial Coaches, but they are not.

Let’s suppose you had to leave your child in someone’s care, what are the things that would be important to you?

Skill? Yes! Experience? Yes! But there are other parameters that are EVEN MORE important!

Such as-

Would the person take care of your child as if she were their own? Will they put your child’s interest above everything else and do the right thing for her? Is this their core area of expertise? Do they have the right people and the right facilities?

Your money too is like your child. It’s hard-earned. It’s your countless years of toil and sacrifice. Then why do we not take the same care when it comes to hiring a Financial Coach?

So, how should you choose your Financial Coach?

Ask these 6 questions while choosing your Financial Coach –

1.Is the person qualified?

Does the person have the right professional qualifications to be a Financial Coach? For example CFA, CFP, etc.

2. What is their motivation to work?

Most of the private banks and Mutual Fund/ insurance distributors give you free guidance but are primarily sales people always on the lookout to sell more products to earn higher commissions.

3. What are they promising to deliver?

Is your Financial Coach promising you the highest returns? No good Financial Coach in his sane mind will ever do so. They should be the ones telling you not to believe in theories of 30% returns!

4. Will they create a written financial strategy?

Most so-called Financial Coaches only guide you on what stocks or Mutual funds or insurance policies to invest in. They are product specific. The right coach will first create a blueprint of your financial roadmap for you. This will give you a clear picture of what you need to save and invest in to achieve your goals.

5. Will they follow a process?

Just like a doctor first diagnoses and then recommends a treatment, the right Financial Coach will first ask questions about your family, your goals, income, expenses, liabilities, insurance, investments, tax situation, wills, nominations etc. Second, they will conduct a financial fitness check and lastly, recommend investments. Without this process, it’s just like a doctor recommending medicines without doing a diagnosis.

6. Will they work in coordination with your CA, lawyer, agent, bank?

Most doctors have no time and get hassled during tax season, particularly with queries from their CA. Your Financial Coach should be able to take that worry off you by working as a team with your CA/Lawyer/bank.

We hope this gives you much clarity on how to evaluate the right Financial Professional for yourself!