- The Reasons Why their Financial situation is Unique!

Indian doctors are amongst the best in the world – in terms of knowledge, expertise and quality of treatments. They are the most intelligent and hard-working section of society. But this VERY quality of being knowledgeable and intelligent comes in the way when it comes to managing finances.

Over the last 16 years, all doctors have asked us, “Why a dedicated Financial Practice for doctors? Are we from Mars? We handle Life and Death situations, what’s the big deal about money?”.

Well, it is a big deal. BECAUSE A DOCTOR HAS A UNIQUE LIFECYCLE.

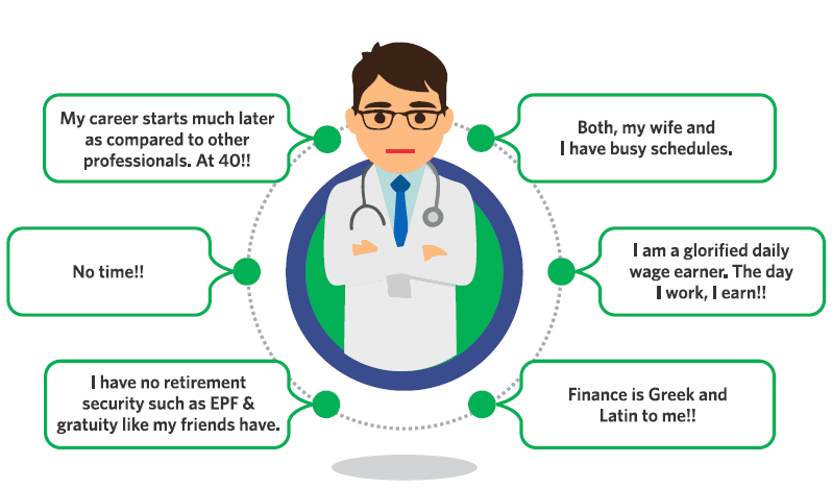

This is what most doctors have told us

1. You spend most of your youth (age 25-35 years) studying and investing in yourselves; while most of your counterparts in other professions start earning handsomely by age 25 years.

2. Your work schedules are so tight that you and your spouse have no time to meet, let alone discuss how to save and invest your hard-earned money.

3. As you are kept away from the financial world for a long time due to the nature of your profession, the financial language becomes Greek and Latin. Most doctors we know have neither inclination nor the time to understand. They rather concentrate on their work which is their passion. Hence, they often get taken for a ride.

4. Most of you would also admit that you start earning handsomely only post the age of 40 years. Most other professionals get a head start of 15 years. They probably are dreaming of retiring soon while you have just begun. Besides, your earnings largely depend on the no. of days you work and the number of patients you see. This leads to uncertainty and insecurity of income.

5. Again, the peak earning time (age 40- 60 years) is also the time when expenses peak – kid’s education, home loans, travel, marriages etc. This leaves you with lesser bandwidth to save and invest.

6. Last but not the least, there is NO RETIREMENT AGE. Yes, most like to slow down after about 60 years of age. But at the same time, since your earning cycle starts late, you have a shorter time period to invest for your retirement/cooling off period.

These challenges lead to mistakes that can be easily avoided such as:

- Investments are done on instructions or tips received at different points in time from friends/family

- Using Insurance policies as an Investment tool

- Having a considerable sum of money locked in a Fixed Deposit

- Money lying in the savings account, earning only 4% interest (2.8% Post-tax)

- Not having the right Life Insurance Cover and Disability Insurance

- Over – concentration in Real Estate

- No retirement and estate planning

It is, therefore important for doctors to have THE RIGHT FINANCIAL COACH in life, someone who is unbiased, who will guide you to tide over these challenges and make your money work for you.

We will address the same in the coming articles.

Stay tuned!