For quite a few years now, our team has been asking people, this question: How do you take financial decisions ??

The responses have been wide-ranging. Most people adopt a very ad-hoc approach. If they have liquidity and money in the bank, they end up buying investments from the first sales-person walking in to sell a product. What they do not realize is that adhoc actions will only lead to random results. Others research the ‘product’ that they are thinking of buying and think that they are doing the right thing. But even they have got it wrong.

As an investor and decision maker, the first thing you need to do is ask, “Why am I investing?” It is this question which gets skipped too often.

In the world of investing, people start with the product and related matters:

– What stock or fund am I going to buy today?

– What asset allocation should I use?

– What estate planning strategy should I adopt?

Just like doctors do not write a prescription before they examine a patient, it is strange how people working in the more traditional parts of the financial services industry have used the product-first approach for decades. Only after pushing you to buy a certain investment do many advisors even attempt to fit it into a larger plan.

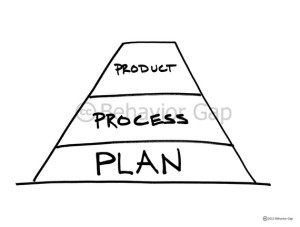

There is an urgent need to invert the traditional decision triangle. Start with the plan (ask why), then move on to the process (ask how) and only then look for the specific products (ask what).

Most of us are trained to think “What” first, because it’s what you hear about all day long. It’s the message you read in some financial publications and see on TV. But “What” questions should come after we think about “Why” and understand “How.”

Starting with “Why” means achieving clarity about your personal financial goals and creating a plan. To reach that point, you need to consider your values and then set some broad goals.

Coming back to our first question: How do you take financial decisions ?? The answer is : Make a plan and use it as a living document to base all your decisions.

Investment decisions like buying or holding are best made when you do so in the context of your financial goals. Picking the next Apple is not a financial goal. Saving for retirement or having enough money to send your kids to college are financial goals. Once we’re clear about the why, about the goals, and we have a simple framework to represent a plan to get there, making investment decisions becomes much more simple. – Carl Richards ( www.behaviorgap.com)

So that’s the investment idea of the month: Let’s make a plan and stick by it!!

Did you find this piece helpful? We thrive on your feedback and are always eager to hear and learn from you. Look forward to your comments.