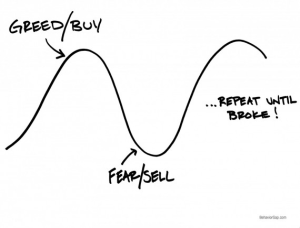

Think about this pattern for a minute.

At the top of the market we can’t buy fast enough.

About three years later at the bottom, we can’t sell fast enough.

And we repeat that over and over until we’re broke.

No wonder most people are unsatisfied with their investing experience.

– Carl Richards (The Behavior Gap)

The problem is to recognize that, in aggregate, investors tend to be very bad at timing the market. The other problem is that though we recognize this as self-destructive behavior, we will still fall prey to the proverbial ‘Siren Call.’

So whats the solution?

Professor Shlomo Benartzi (UCLA; of the ‘Saving for tomorrow, tomorrow‘ TED video fame – dont miss the part where he says – “Self-control is not a problem in the future. It’s only a problem now when the chocolate is next to us”) has a very simple yet powerful antidote to remedy this age-old behavioral short-coming.

He calls upon investors to make an Ulyssesan Contract: a decision made in the present to bind oneself to a particular course of action in the future.

“It derives from a strategy that Ulysses adopted on his journey home from the Trojan wars, which took him and his ship’s crew close to the Sirenusian islands, famous for being home to the Sirens, whose songs were so irresistibly seductive that seamen felt impelled to fling themselves into the waters, in an attempt to reach the Sirens. No seaman ever survived, so no living human knew the nature of the Sirens’ songs.

Ulysses wanted to be the first human to hear the songs, and survive. He instructed his crew to fill their ears with beeswax, to block out the sound, and then tie him to the mast and to ignore his pleas to be released, should he do so. The plan worked. Ulysses heard the Sirens’ songs, the crewmen ignored his entreaties to be untied and when they were out of earshot, he gave a pre-arranged signal to take out the ear plugs and release him. Ulysses had committed himself to a rational course of action at a neutral time, that is before he could hear the Sirens’ songs, and ensured that he stuck with his decision. This action of pre-commitment is the work of the reflective mind.”

Every investor has a lesson to learn from this mythological story. Just like Ulysses conquered this known limitation of the human mind, financial advisors should simulate the strategy and invite their clients to engage their reflective minds to pre-commit to a rational investment strategy in advance of movements of the market that might otherwise trigger irrational responses of the intuitive mind.

As Benartzi emphasizes:

Pre-commitment to a rational investment plan is important, because the intuitive impulse to act otherwise is strong.

There are two-parties to such a contract. The investor (Ulysses) who is committed to not let emotions get the better of him, and a trusted advisor (the crew with beeswax)

The Ulysses Strategy in-Action:

- Understand the sometimes impulsive nature of investment decisions.

- Agree upon what action should you take when, for example, the markets move 25 percent up or down.

- Draw up a commitment memorandum, with both client and advisor as signatories.

Nothing beats Inaction but ACTION:

Take up this challenge. Go ahead. Draw a Ulysses Contract to yourself and try to stick to it the next time the markets are irrational. I am sure that having taken this step will help you to pre-commit to rational action before the weather gets rough.

Did you find this piece helpful. We thrive on your feedback and are always eager to hear and learn from you. Look forward to your comments.